A church budget is more than just numbers; it’s a strategic tool that aligns your financial resources with your ministry goals. Despite its importance, many church leaders may overlook budgeting, often prioritizing immediate ministry needs over long-term financial planning. However, a well-crafted budget is essential for maintaining paid staff, supporting ministries, and keeping facilities in good condition.

This guide provides a comprehensive look at the church budget and general fund, offering practical insights and strategies for financial stewardship.

Why Do You Need a Church Budget?

Churches, like families and governments, require budgets to outline how they generate and allocate funds. Church budgets serve as a guiding blueprint for leaders to follow and implement.

Adhering to a budget also fosters accountability within the congregation and enables churches to fulfill their mission of expanding their reach and sharing God’s message.

Church Budget Statistics

Data-driven insights can significantly enhance your budgeting process. By examining average church budget allocation statistics, you can better understand how to distribute funds effectively.

Did you know? On average, churches allocate 50-60% of their budget to staffing, including salaries, benefits, and support for pastoral and administrative staff. Approximately 25-30% of the budget is commonly set aside for ministries and outreach, ensuring that resources are available for local and global missions, youth programs, and community events.

Facilities management is another major expense allocated by cost per square foot instead of a percentage. These costs include utilities, maintenance, insurance, and upgrades. Churches with older buildings may need to allocate more for maintenance and repairs, while newer facilities may face higher utility costs due to modern technology use.

Understanding these trends can help ensure your budget is realistic and aligned with your church’s goals.

Church Budget Categories

When crafting a church budget, it’s essential to consider various categories supporting the church’s mission and operations. Below are a few to keep in mind.

Income Streams

The foundation of a church’s budget relies on various income streams. These include donations from the congregation, fundraising events, and other sources. Understanding the sources of income is crucial for effective financial planning.

Staff Expenses

A significant portion of the church budget goes toward staff expenses. This includes salaries and benefits for pastors, administrative personnel, and other employees. Managing staff expenses is essential for the financial health of the church.

Admin and Operations Costs

Admin and operations costs encompass expenses related to the day-to-day running of the church. This category covers office supplies, utilities, insurance, and other essential operational expenses.

Facilities and Equipment Maintenance

Maintaining the church’s facilities and equipment is critical to the church budget. This category includes facility repairs, equipment upgrades, and general maintenance expenses.

Tip: Creating a line item for a church facility management software, like eSPACE, can serve as a solution for effective facility asset management and work order tracking. Book a free 30 minute training here.

Direct Ministry Program Expenses

Direct ministry program expenses are funds allocated to support the various ministries and outreach programs of the church. This category ensures that these programs can continue to serve the community effectively.

Outreach Costs

Outreach is an integral part of church ministry. Budgeting for outreach costs includes funds for community events, mission trips, and efforts to connect with the local neighborhood.

Church Growth Fund

The church growth fund is set aside for expansion, renovation, or other initiatives to grow the church and its impact on the community.

Reserve Funds

Reserve funds are a safety net for unexpected expenses or financial emergencies. These funds provide financial stability during challenging times. An operating contingency reserve fund is your church’s financial cushion for unexpected operational expenses, such as emergency repairs, unplanned events, or dips in income. It ensures the continuity of day-to-day operations without disrupting your budget.

Separate from the operating contingency, a capital reserve fund is dedicated to long-term investments in your church’s facilities and infrastructure. This fund covers major expenses like building renovations, new construction, or large-scale equipment replacements, ensuring your church is prepared for significant capital projects.

Debt Repayment

If the church carries debt, a portion of the budget is allocated to repayment. Managing this category ensures financial responsibility.

Technology Costs

Churches often rely on technology, such as software, for various functions, such as financial management, communication, and member engagement. Budgeting for software and other tech costs is essential to maintain the church’s digital infrastructure.

Software to Aid in Church Budgeting

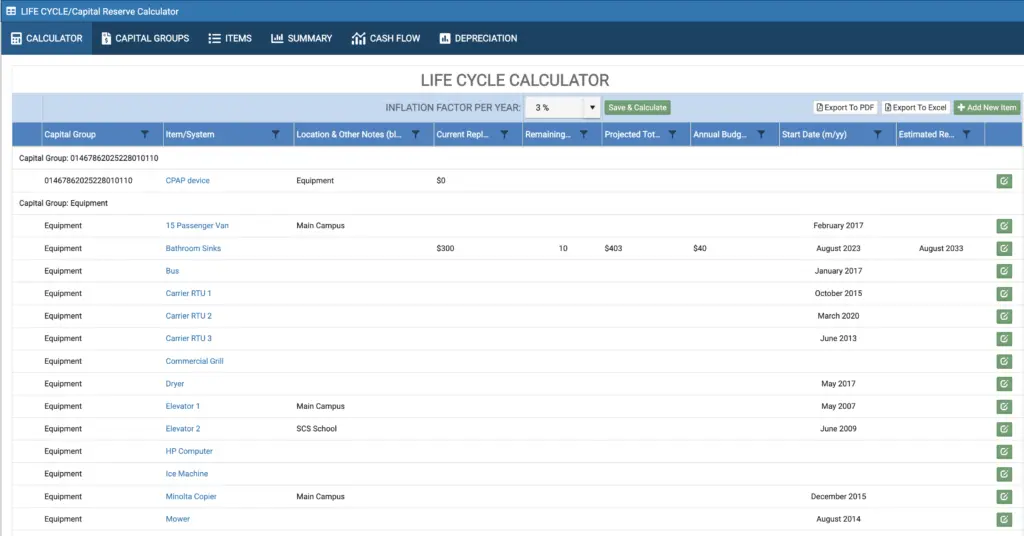

Managing a church budget can be complex, but the right software can simplify the process. Tools like Smart Church Solutions’ Life Cycle Calculator (LCC) provide a comprehensive approach to facility budgeting, helping you plan for long-term maintenance and capital expenses. By integrating budget software into your financial planning, you can improve accuracy, reduce manual errors, and make data-driven decisions that benefit your church’s future.

Get detailed guidance on church budgeting for free with the Church Facility Budgeting and The Four Buckets of Church Facility Budgeting eBooks. These resources are packed with expert advice and practical tools to help you navigate the complexities of church finances.

The Truth: Ministry Costs Money

Effective ministry requires financial resources, and the church budget is the framework that supports this. By aligning your budget with your church’s vision and mission, you can ensure that your ministry thrives, even in challenging times. Remember, budgeting is not just a financial exercise; it’s an expression of your commitment to stewardship and the growth of God’s kingdom.

How to Handle a Potential Church Budget Shortfall

In the face of potential financial challenges, churches must navigate the intricacies of handling a budget shortfall with foresight. Here are a few practical strategies for addressing such shortfalls while upholding the mission and financial stability of the church.

Reduce Expenses

The first and potentially the most obvious strategy for churches is to reevaluate their budgets. This evaluation is essential to navigate funding shortages and respond to emerging ministry opportunities. While churches typically create annual budgets, they may not be accustomed to scaling back their budget as required during challenging seasons.

Recurring Church Operation Expenses

A significant portion of the church budget includes recurring operational expenses. This category includes mortgage or rent for church facilities, utility expenses, janitorial services, general maintenance, and capital reserve savings. It is crucial to manage these expenses efficiently to ensure the church’s financial stability.

“Too many churches just cut these budgets without understanding the long term impact.” — Tim Cool

Ministry Expenses

Ministry expenses encompass all costs associated with the various church ministries. It is essential to prioritize high-impact ministries and consider eliminating ineffective ones. Trimming non-essential expenses can help reallocate funds more effectively.

Staff Expenses

Staff expenses often represent the largest portion of the budget. Consider implementing voluntary pay reductions, across-the-board percentage pay cuts, or, as a last resort, eliminating certain positions. While these decisions are challenging, they may be necessary to ensure the church’s sustainability.

Zero-Based Budgeting

Another approach is zero-based budgeting. This method involves thoroughly reviewing the entire church budget to reduce expenses and refocus resources on crucial ministries. While not commonly used, the current cultural shift and the potential crises many churches face may make this approach more appealing. It also provides an opportunity to align the budget with new strategic priorities.

Increase in General Fund Giving

The second overarching strategy for addressing budget shortfalls involves increasing general fund giving. Here are two primary ways to raise additional funds:

Discipleship for Generosity

Develop a comprehensive discipleship process focused on financial stewardship. Most churches lack a complete discipleship process for financial stewardship. This strategy aims to educate and engage the congregation in matters of financial generosity and stewardship.

Find Alternative Funding Sources

As the cultural landscape changes and government support for churches decreases, finding alternative funding sources becomes crucial. Church leaders must explore new avenues, leverage assets, serve the community, empower entrepreneurs, and create multiple income streams to support the church’s mission and outreach.

The Bottom Line on Church Budgets

The church budget is not just a financial document; it reflects the church’s vision, values, and commitment to ministry. In a world of changing demographics and giving trends, churches must adapt to financial challenges. The Bible encourages faithful stewardship, and wise budgeting is an essential part.

To learn more about effectively managing your church’s facility budget through streamlined solutions, request a demo with our team today.